eToro Review 2024

Content is not intended to UK users

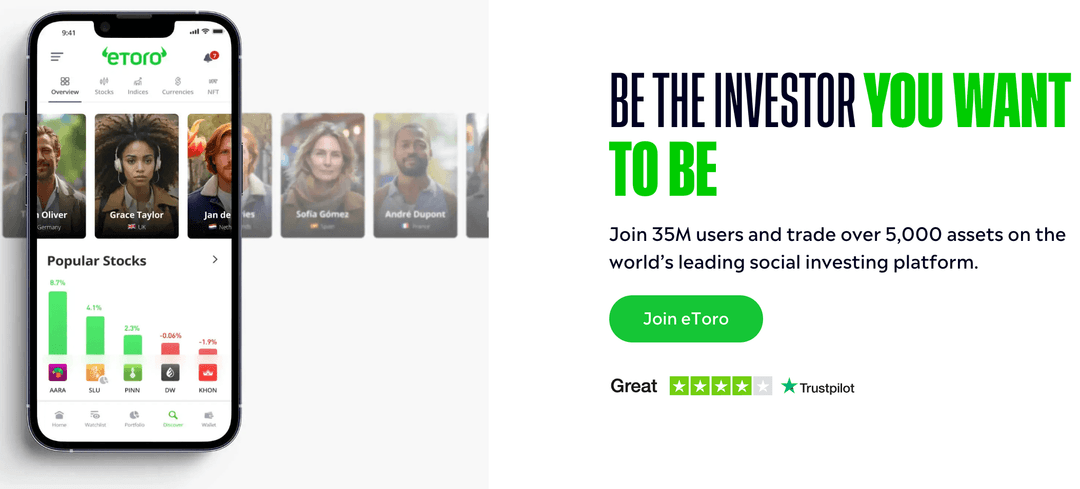

Featuring a forward-thinking approach for newcomers to investing, eToro makes that first step into trading much more streamlined. This goes for a wide range of commodities, such as stocks and cryptocurrency, to name a few.

Aside from simplifying market access and navigation, eToro supports a social community of engaged users. This means traders can interact with each other on the platform, discuss investment options and strategies, and optimize their results.

Part of what makes eToro an effective choice for new users is its hands-on approach to learning the ropes. The platform ensures traders take full control of their investments while providing the support they need for actionable decision-making. In this review, you’ll get a comprehensive look at eToro, what makes it great, where it could improve, and whether it’s the right choice for you.

Overview of eToro

With over 15 years since its inception, eToro has come a long way from its humble beginnings. Starting out strictly as a forex trading platform, the founders had plans for big changes only a few years down the road.

The eToro you see today is fully stacked with access to several financial markets, trading tools, and a community you can lean on. You can even find their WhatsApp contact number if you really need help. Boasting over 30 million users on a global scale, it's easy to assume the company has a rich history to reflect on.

Company history

Any organization is guaranteed to have its ups and downs. However, eToro's timeline has been rather aggressive, with new updates every year or two. From its inception in 2007 to now, eToro has continued to adapt to changing times in financial markets. For a brief overview of the company's history, the timeline below highlights how eToro has changed and grown over time.

- Jan. 2007 - eToro was founded by three entrepreneurs named Yoni Assia, Ronen Assia, and David Ring.

- Sep. 2007 - The very first usable version of eToro goes live with graphic representations to make trading more interactive and engaging.

- May 2009 - A newer and more intuitive version called WebTrader is launched, featuring more professional trading tools. This helps to develop interest between novice and experienced investors.

- July 2010 - Integration of OpenBook, the first social investing feature called CopyTrader™, helping traders interact and learn from others on the platform.

- April 2012 - Both OpenBook and WebTrader are available on mobile for both Android and Apple users.

- July 2013 - Numerous stocks are added to the eToro platform.

- Oct. 2015 - A single interface is created to combine the features and benefits of OpenBook and WebTrader.

- Feb. 2016 - Inclusion of asset grouping and AI-supported portfolio creation that’s market-based.

- Feb. 2017 - Digital assets such as XRP and Litecoin were introduced.

- Mar. 2019 - eToro’s services open up in the United States as a crypto-only platform.

- May 2019 - Not only have stocks been introduced, but they come with 0% commission.

- Nov. 2021 - Instant withdrawal and zero FX conversion fees are offered through their eToro Money service.

- Jan. 2022 - Fractional share investing and launch of stock investments in most U.S. states, furthering their global reach

Key features

It’s safe to assume that eToro is far from being done, and its track record and history are something investors can rely on. However, reviewing the key features of eToro can help paint a better visual of how the platform would align with your particular needs.

There’s definitely a long list of features associated with eToro, but some stand out for a reason. Between platform tools, market education, and community support, there’s plenty for traders to take advantage of. The sections below offer a brief take on the multi-faceted nature of eToro’s features.

Trading tools

Make use of virtual trading through demo accounts for practice, or dive right into social copy trading. Getting involved doesn’t mean you have to throw down money immediately. Users find more than enough room to test the waters without feeling like they’re risking too much.

Investment variety

With the ability to trade over 3,000 different assets, 52 forex pairs, and many international and U.S. stocks, traders have more than enough to choose from. In the past, investors would have to bounce from one platform to another just to find what they were looking for.

eToro aims to offer most, if not all, of what you need under one roof. From casual investors to dedicated day traders, both can find success in eToro’s platform.

Mobility

Thanks to eToro’s mobile applications, traders can easily access their accounts no matter where they are. Some of the most common benefits here are watchlist syncing, helpful charting tools, and basic market alerts.

Research and education

Between their own commentary on the state of the market and vast educational resources, eToro never leaves its users in the dark. Social sentiment and analysis tools are a part of this as well, and users have many videos and webinars they can review at leisure.

eToro has encountered its fair share of roadblocks over the years, but it always aims to adapt. Meeting the needs of traders and necessary regulation seems to be at the forefront of eToro's mission. In short, that platform's historical approach to new features, security, regulation, and innovation has been positive for the most part.

Is eToro Safe?

When you look for security benefits like encryption, that’s just surface-level expectations, and eToro goes much farther than that. First and foremost, compliance with regulation should be a primary concern for any trader. For users of eToro, this information isn’t hard to come by.

At this time, eToro is operating under the following regulations:

- Cyprus Securities and Exchange Commission (CySEC)

- Australian Securities and Investments Commission (ASIC)

- Financial Conduct Authority (FCA)

- Malta Financial Services Authority (MFSA)

It's equally important to discern the associated licenses as well. eToro is licensed by Abu Dhabi Global Market (ADGM) and holds many other relevant licenses to operate lawfully in numerous jurisdictions.

This may all seem like technical jargon on the company website, but it's a vital component of any safe investment platform. License and regulation may be important, but it isn't the end of all be all of investor security. You'll find that eToro promises Securities Investor Protection Corporation (SIPC). This provides insurance on equity assets like ETFs and stocks for up to $500,000. Better yet, this also includes $250,000 for cash claims.

On top of this, eToro's clearing partner, Apex, offers supplemental insurance. This protects eToro clients with up to $37.5 million in securities and $900,000 in cash for each person. Other notable layers of security include standard two-factor authentication and the eToro Wallet for holding cryptocurrency.

Users can also transfer crypto from their eToro account to their preferred wallet. The only caveat here is that this transfer is a one-way ticket and can't be sent back to your eToro account. However, with a handful of tips and tricks, you can avoid any unnecessary hurdles, protect your assets, and make the most of eToro's features.

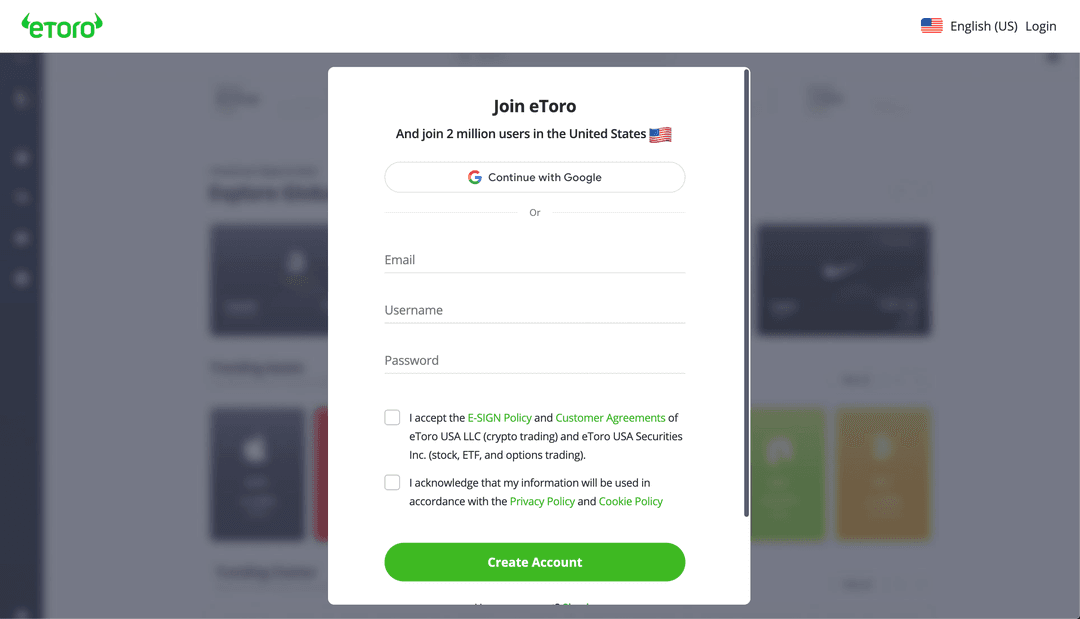

Account Opening

Setting up an account is the easy part, as this only requires a username, email address, and a unique password. You can find the signup button at the top right of the eToro homepage. While they make it easy to accept the platform's terms and conditions, it's crucial you understand what you're agreeing to before moving forward.

You'll also be prompted to accept the website's privacy and cookie policy. Once those steps are completed, it should only take a few minutes to receive a verification email from eToro in your inbox. Aside from this, you will find several other requirements before you're free to use eToro freely.

Client requirements

It's important to note that new accounts are required to go through a KYC verification process. This includes providing a confirmation of where you live as well as identity proof, such as a passport or issued photo ID.

As an additional step to the verification process, new investors will need to fill out a questionnaire. eToro uses this information to custom-tailor service packages to the unique needs of each investor.

Minimum deposit

The amount you're required to chip in for your first deposit varies depending on your location. However, after your first deposit, deposit minimums drop to $50. Except for the U.S. and U.K., as it drops to $1 and $10 respectively. For a better scope of minimum deposits, the table below groups various regions with their minimum deposit requirements on eToro.

Minimum First Deposit by Location

$50: Australia, Cyprus, Estonia, Finland, Germany, Greece, Guernsey, Hungary, Latvia, Liechtenstein, Malaysia, Malta, Singapore, Spain, Taiwan, Thailand, Vatican City.

$100: Austria, Belgium, Czech Republic, Denmark, France (including French Guiana, Guadeloupe, Ireland, Martinique, Mayotte), Italy, Luxembourg, Netherlands, Norway, Monaco, Poland, Portugal, Romania, Slovakia, Slovenia, Sweden, Switzerland, UAE, U.K., U.S.

$200: All other eligible countries.

$1,000: French Polynesia, Isle Of Man, Jersey Island, Kuwait, New Zealand, Reunion Island.

$2,000: Bulgaria, Cayman Islands, Croatia, Gibraltar, South Africa, Vietnam.

$10,000: Israel.

Another important detail here is that these amounts are only relevant to personal accounts. This leads to the next point, which is the various types of accounts that eToro offers. Company accounts are another prominent example. Unfortunately, the reality is that the platform doesn't offer many account options.

Account types

For the everyday investor, there isn't much to worry about. However, those looking for more comprehensive account options won't find a long list with eToro.More specifically, limited brokerage and options accounts are all you can choose from.

If you were hoping for retirement savings accounts, joint accounts, or custodial accounts, you’re going to have to look elsewhere. On the other hand, if you’re simply looking for some practice on the market, that’s something eToro can help with.

You can navigate their platform through a demo account that lets you trade with fake funds. This gives you the benefit of testing the waters and your strategies without having to risk your money. Nevertheless, account types with eToro are pretty straightforward. Once your account is up, it's time to start exploring the user interface.

eToro Trading Platforms

The eToro you see today isn't what it always looked like. While traders can accomplish many of the same things on the web or mobile, they offer unique experiences. It should be noted that regardless of the device you're using, both web and mobile versions include WebTrader and OpenBook features. Although there aren't too many differences between the two, they aren't necessarily identical.

Mobile app

Available for both Apple and Android OS, the eToro mobile app allows traders to perform any action from the palm of their hand. This is used to be exclusive to the web platform, but eToro has made its services accessible across the board, regardless of your device.

Some of the core benefits of the mobile app include:

- Simpler and more efficient functionality

- Basic to intermediate charting

- Quick navigation, perfect for fast-paced decision-making

- Accessible from a variety of mobile devices

- Actively sends notifications and alerts surrounding important account events

On another positive note, both eToro applications are generally highly rated by their users. Some might argue that the mobile app is more user-friendly, but you may not have as much visibility.

Web platform

When you’re working with the web platform, this is where you can take full advantage of professional tools. From in-depth analytics to the vast benefit of social trading, you’ll see a slight difference in the UX between mobile and web versions.

However, eToro has done a great job optimizing this experience over the last few years. That's why their services are much more uniform now across devices. Instead of feeling divided between one UI over the other, simply use both to your advantage based on your current needs.

Overall, the benefits of using the web platform include:

- Much more detailed interface

- Greater variety of chart types to monitor

- Easier to navigate research, tools, and educational material all at once

- Faster processing of actions due to more stable connections and hardware

You’ll find that some minor website functionalities may be limited on mobile compared to desktop. This is nothing that should be seen as a deal breaker, as all the core functionalities are still there.

Products and Services

Among the many digital assets you can choose from, eToro gives you plenty of instruments to work with. The list of instruments available may seem rather small, but they’re able to translate into many other potential investment opportunities.

Here are the various instruments that eToro supports:

- Bitcoin (BTC)

- The original peer-to-peer digital currency is now the leading benchmark for all other crypto assets. Bitcoin is also used as an investment and to handle online payments.

- Ethereum (ETH)

- Seen as the runner-up to BTC, Ethereum found its own place in the market. While ETH has gone through many changes, it stands as a decentralized and open-source blockchain system. It's a safe and reliable investment that acts as a platform to trade many altcoins. This is in addition to executing decentralized smart contracts.

- Amazon shares (AMZN)

- Aside from its own investment value, it's a reliable asset that can help navigate other opportunities in the market. More specifically, AMZN is a part of the stock market and not cryptocurrency.

- Tesla (TSLA)

- Considering the company's forward-thinking endeavors in tech, lifestyle, and innovation, Tesla stock can be a helpful resource. It isn't uncommon for investors to use TSLA as a gateway into a variety of other assets.

- Apple (AAPL)

- Although this is a company name that speaks for itself, its stock has gone through numerous ups and downs. Traders don't always keep it on hand for its holding value. With eToro, it is used as a popular instrument for many other potential investment decisions on the platform.

- Nio

- The Nio organization is focused on autonomous electric vehicles. Other associated value-added services include third-party liability insurance, routine maintenance, and much more.

Having this kind of variety can make it feel like you have free range, but it's important to take full advantage of the eToro platform. Instruments are just one focal point, as research and analytics tools and special platform features are crucial to understand as well.

eToro Fees and Commissions

Due to the nature of online investing, most people expect a nuance of fees to be associated with platforms like eToro. Although this isn’t the wrong outlook, it’s much more important to focus on what is and what isn’t. To help summarize this information, the platform broke this information down into several categories.

Investment account fees

Opening an account and managing it doesn’t come with any kind of fee. There is a withdrawal fee of $5, and there’s a charge of $10 per month for accounts with no logins in the previous year. eToro accounts are based in USD, which means you’ll encounter a conversion fee if you deposit or withdraw in another currency.

Stocks

As of August 11, 2024, some traders may encounter a stock commission fee of $1 to $2 when they open or close a position. This is only for select locations such as:

- Denmark

- Finland

- Netherlands

- Norway

- Portugal

- Spain

- Sweden

- Australia

- New Zealand

However, any position opened before this date will not encounter a commission fee when it's closed. It's also important to highlight that this doesn't apply to CFDs, ETFs, copy trading, or smart portfolios. Electronic purchases of UK-listed stocks come with a stamp duty reserve tax of 0.5%. While CFD positions on stocks don't generate a commission fee, some stocks can be executed as CFDs. This can lead to CFD spreads and overnight fees. Here, fees can range from 0.15% to 1%. Overnight fees are adjusted on a unique, case-by-case basis.

ETFs

Free of all fees related to commissions, eToro spread, market spread, overnight, and custody fees. In a similar fashion to stocks, ETFs can be subject to CFD spreads or overnight fees if short-selling orders and leveraged positions are executed as CFDs.

Crypto

Simply put, the buy-and-sell fee for cryptocurrency is only 1%. You won't run into any other fees outside of that unless you transfer to an external wallet. The coin transfer fee is generally 2% but may vary for those with larger positions. From another angle, crypto CFD positions incur overnight fees.

CFDs

Fees and charges associated with CFDs can vary quite a bit, and this is based on numerous factors. Traders can expect varying eToro spread fees and an overnight fee for CFD positions that remain open throughout the night. Remember, overnight fees are adjusted based on current global market conditions.

Copy trading

One of the biggest selling points for the platform the CopyTrader™ and Smart Portfolios, don't come with any fees. No hidden fees or charges outside of the norm, and you won't encounter management or commission fees with Smart Portfolios either.

eToro Money

The eToro debit card, zero-fee deposits, and instant withdrawals are just a few benefits of eToro Money. There are essentially zero fees across the board, except for one small area. Understandable, to say the least, users will find a replacement card fee of $10 or $80, depending on the card type.

The Green eToro card offers transactions of up to $2,000 per month to be free of any fees. The same goes for the eToro Black card, but the limit here goes up to $10,000. If you go over the limit of your respective card, a 1% fee is tacked onto transactions until the next monthly cycle.

eToro Money Crypto Wallet

It's entirely free to open or close an eToro crypto wallet, and there are no additional fees for sending and receiving transactions. This does come with a few limitations. There's a permitted maximum of $50,000 per transaction and a $200,000 daily maximum limit.

This is about as comprehensive as it gets. As a final overview, it can be helpful for any trader to make some comparisons between other relevant platforms similar to eToro.

| Comparison | eToro | Robinhood | Coinbase | Uphold | Crypto.com |

|---|---|---|---|---|---|

| Fee | 1% on crypto | 0% per trade | 0% - 3.99% based on transaction type | 0.95% for makers and 1.25% for takers | 0.40% for makers and 0.40% for takers |

| Crypto assets available | 30 | 15 | 247 + 589 trading pairs | 250+ | 170+ |

Deposits and Withdrawals

The terms themselves are pretty simple in today’s world, but that doesn’t mean they don’t come with some fine print. Overall, eToro has made both processes pretty quick and straightforward. Although they’ve done a good job to avoid the hassle, new traders shouldn’t walk into these actions blindly.

Making a deposit

The easy version starts with logging into your account, click on the “Deposit Funds” option, enter the desired amount and preferred method, and proceed. Here are a few minor details any investor will want to keep in mind.

- Don’t forget that the minimum first deposit varies by region, ranging from $10 to $10,000

- Accounts that aren’t verified will have a deposit limit of $2,250.

- All trading accounts operate in USD, which means currency conversations can come with a fee.

- Using eToro Money avoids any conversion fees and includes competitive FX rates on international card use.

- Processing times are nearly instant, aside from bank transfers, which can take four to seven business days.

You also won't have to deal with much downtime when it comes to making a deposit. Users are able to make deposits via bank transfer, credit or debit card, and even Klarna, just to name a few. Depending on the payment method, each type comes with its own limitations on single deposits that range from $11,500 to $500,000. With just a few clicks, you can get your funds ready to go for the next trade.

Initiating a withdrawal

There's no restriction on when you can request a withdrawal up to your account balance. Keep in mind that the margin used is taken out of this equation. Most withdrawal requests are confirmed within two business days. However, it could potentially take up to 10 business days for the funds to arrive.

The following payment methods are eligible for withdrawals:

- eToro Money (Instant)

- PayPal (2 days)

- Neteller (2 days)

- Skrill (2 days)

- Trustly (2 days)

- iDEAL (2 days)

- Credit/debit card (10 days)

- Bank transfer (10 days)

Actual transfer times may vary depending on a wide range of factors, such as your payment method, banking institution, and time of withdrawal. It's important to remember that the withdrawal limit is $30, and you need a verified account to be eligible. Amounts over $30 are also subject to a processing fee of $5.

Research and Education

From advanced charting tools to asset screening tools, you can hone in on the best investment possible with simplicity. This is part of what makes eToro so streamlined, and it goes beyond rudimentary crypto charts.

Traders get the benefit of asset history analysis and data filtration. Other notable features here include accumulative swing index and Fibonacci retracement. As always, you can’t forget about the copy trading feature, as this can help guide user analysis and decision-making if handled with care.

The research and education eToro offers is much more than just lines on a screen. Although that data is important, eToro understands traders need more support than that.

Educational material

Whether you’re new to investing or looking to further your education, eToro offers comprehensive source material. It’s a lot more than you might expect, and you can learn more about several examples in the list below.

- eToro Learning Academy: Includes updated articles, videos, and even weekly webinars.

- Integrated Education: You can find additional details next to trading symbols to help guide investment decisions and minimize risk.

- Accessibility: All of this information is freely available, but there’s a heavy focus on crypto, trading strategies, and Smart Portfolios.

- Form Variety: For quick bites and long-form readers, eToro has a bit of everything to cater to different audiences and content interests.

Of course, in the world of investing, one might wonder how valuable this information actually is. This is where many question the quality of eToro’s research, which can’t be perfect 100% of the time. Sure, trading includes some trial and error, but you don’t want to blindly trust the first bit of advice you see on your screen.

Quality of Research

With a vast amount of research to pull from, eToro traders are never left in the dark. On the surface, you get the help of in-house analysis on top of weekly articles and video updates. Past that, you can put your hands on a variety of research tools.

Some of these include:

- Economic calendar

- Earnings reports

- News headlines

- Podcasts

- And more

Other notable efforts include TipRanks, which helps with research on non-forex assets. Take advantage of fundamental analysis for shares trading. The only primary downside here is that you won’t get much out of technical analysis in this realm.

eToro doesn’t stop there, as you can also dig through research stemming from sentiment data and their up-to-date, Twitter-style newsfeed. To really harness this information, it’s vital to know how to navigate eToro’s special features, such as Smart Portfolios and CopyTrading.

Special Features

With a few clicks on their homepage, you’ll notice that eToro comes with several unique features that help their services stand out. CopyTrading and Smart Portfolios are leading examples. However, you also might be interested in what VIP eToro club members have to gain.

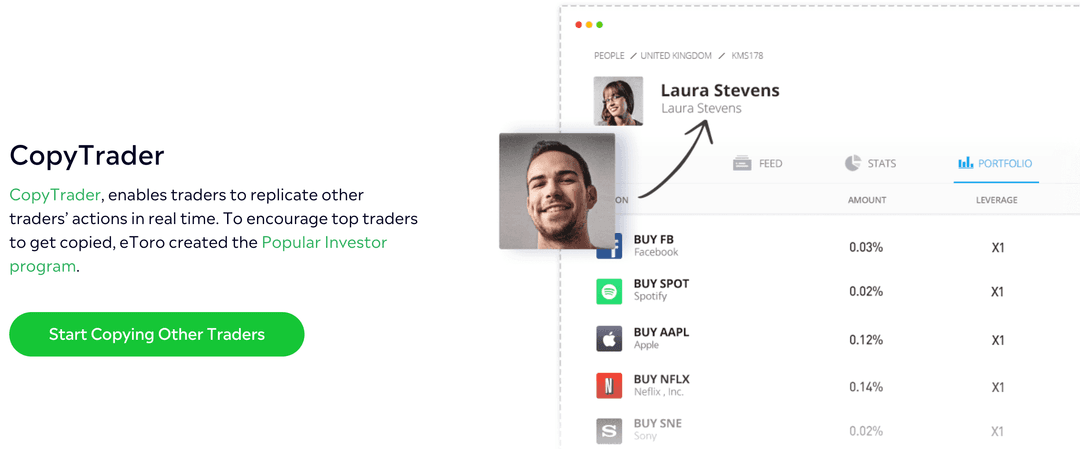

CopyTrading

There's an immense amount of fine print behind this, but it essentially allows users to copy the trades of other investors. It all happens in real-time, and a minimum investment of $200 is required to get started. The limit here is $2,000,000 per trader, but that's more than enough room for most people to work with.

Other important aspects of CopyTrading include:

- Copy stop-loss for risk management

- Automatic reallocation of your positions if the copied trader makes changes

- Easily pause and resume your copy trades

- Put your copy trades to a halt completely, or simply make adjustments as you go

There’s enough leverage to capitalize while remaining safe about your investment decisions. Aside from CopyTrading, a breakdown of Smart Portfolios is equally important.

Smart Portfolios

The aim of smart portfolios is to leverage the large and dedicated eToro user base. Traders get grouped into single funds for copy trading. With this take on automated portfolio management, your investments are reallocated to stay in line with copied traders.

This can be highly beneficial as it removes the risk of drumming up a strategy yourself. You can easily add or remove funds at any time, and it’s a seamless integration that requires minimal interaction on your part. The combination of flexible investment options and copy stop-loss features helps to keep you as secure as possible.

eToro Club

A popular tiered membership program, the eToro Club offers many exclusive benefits. Eligibility for this program is dependent on several factors. This particular perk comes with equity requirements, and you can get a breakdown of the various tiers below.

- Silver = $5,000

- Gold = $10,000

- Platinum = $25,000

- Platinum+ = $50,000

- Diamond = $250,000

Your tier balance is determined as follows: Available cash in your eToro account + total amount invested - excluded products + cash value available in your account. This membership is applied automatically if you meet the equity criteria.

A few examples of the program’s benefits include a dedicated account manager, an eToro debit card, discounted tax returns, and more. It’s true that eToro does a good job of selling its services, but customer support is a driving factor for many users.

Customer Service

The primary downside here is that there’s no phone number to call for prompt action. So, eToro users are left with support tickets and online chat. If you don’t have an account, the only option you have is to open a support ticket.

While this may not be the most efficient choice for everyone, their track record with customer service is pretty positive. You're bound to come across a few bad eggs, but the reviews back up the quality of eToro’s customer service team.

For example, one review mentioned:

“Monika is extremely helpful and reactive. In addition, while being based in Slovakia, I don't speak Slovak, and I really appreciate Monika speaking English. In short, great customer experience. Thank you!!”

by Pierrick Gerard (Slovakia) via Trustpilot

Another avid user stated:

“The platform provides the best customer service among all investing platforms. They assign an account manager to assist you, and they are always helpful, responsive, and patient.”

by George Dayoub (Kuwait) via Trustpilot

When you read one comment after another, the positive sentiment comes from all over the world. Many people also feel the company is quite responsive, even if you’re dealing with support tickets and online chats. For the most part, no complaints from eToro’s user base in regard to their customer service efforts.

Final Verdict

With over a decade of experience on the market and a track record for innovation, educational support, and opportunity, eToro boasts a good look. Sure, it isn’t the perfect solution for every trader out there, but they hit a lot of the marks when it comes to community concerns.

Safety, regulation, opportunity, and communal support are all found under the eToro umbrella. When you tack on the support they provide to their users, people have a lot of incentive to stick around.

Here are a few tips you can take with you on your own investment journey on eToro:

- Be cautious when blindly utilizing copy trading strategies. Short-term results don't always translate to long-term reliability.

- Take note of varying fees across different assets, as well as overnight and weekend fees.

- Don’t overlook the platform’s limitations, such as the inability to transfer stocks to another broker of your choice.

- Make use of alternative investment options like index funds, which are generally low-cost.

- A trader's risk score can be pretty indicative of the consistency of their returns.

Overall, eToro is one of the best options on the market for those who are trying to break into investing. It’s an excellent entry gate for both stock, cryptocurrency, and many other aspects of modern financial markets.